How should inequality in lifespan be factored into policy on the age of eligibility for state pensions?

The arguments for raising the age of eligibility for state pension (superannuation) are familiar, as many countries have followed such a policy. Raising the age of eligibility is a simple and transparent match for increasing longevity by which more people are reaching eligibility age and collecting their pensions for longer. It is consistent with the reality of people retiring later, and sends a signal on normal or expected retirement patterns.

Because of increasing longevity, the cost of state pensions is increasing. Whether that cost continues to be affordable depends on the prospects for economic growth, future tax intake and political decisions on spending priorities. Increasing the age of eligibility would rein back the rising cost. The policy is generally unpopular, but it’s hard to get a clear view on whether it would be more or less attractive than the other options – raising taxes, reducing pension amounts or limiting other spending.

The UK is on a track to increase its state pension age to 66 by 2020 and 67 by 2028. The policy is that everyone across the UK has the same age of eligibility.

A crucial argument against raising the age of eligibility is that it appears to disadvantage people with lower than average life expectancy. The recent Interim Report on the Independent Review of the UK’s State Pension Age asks the very pertinent consultation questions:

“Do you think that regional factors have an impact on Life Expectancy and how? How should the Government factor in the combination of regional and socio-economic factors?”

Look beyond the average to understand variation in lifespans

A previous post examined variations in life expectancy within the UK. It highlighted problems in trying to understand inequality by comparing life expectancies across populations. That approach misses information about the numbers of people dying early and dying late.

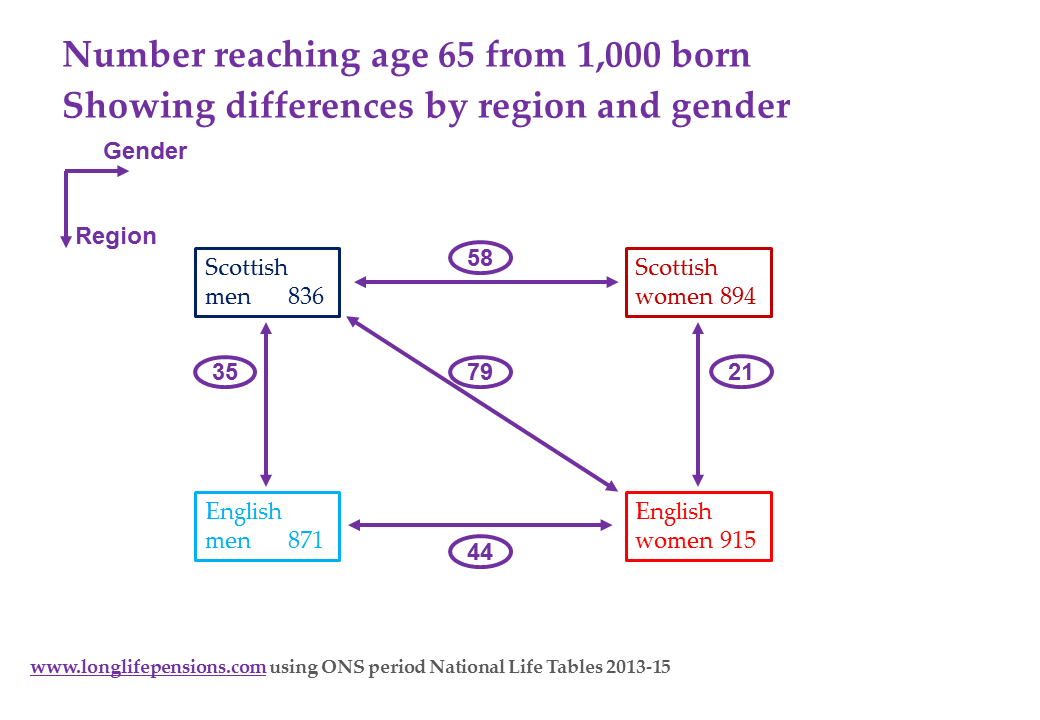

Illustrating using the two populations of the UK countries with the highest and lowest average life expectancy, Scottish males have a lower chance of living to collect the pension than English females, and they are expected to receive it for less time.

For a group of 1,000 Scottish males and 1,000 English females born in 2013-15, and with provisos for the artificial assumption that their mortality rates don’t change over their lifetimes:

- The Scottish males are expected to die on average at age 77.1 and English women at age 83.1 (this is the life expectancy at birth indicator).

- 79 fewer Scottish men than English women are expected to survive to age 65.

- 78 more English women than Scottish men are expected to survive to age 95.

Cannot isolate one determinant of lifespan

This analysis fails to isolate region as the cause of the inequality. There is variation in life expectancy within regions of the UK, even within cities. Location itself may be a determinant of death rates for example, unhealthy air. But many factors combine to cause differences in death rates: gender, education level, region, socio-economic factors, and so on, as well as pure chance. It is likely that factors that might positively or negatively affect death rates accumulate in certain areas.

So, it is not “living in Scotland” alone that is the direct cause of shorter than average lifespan, but many environmental and individual factors that combine to produce a distribution of ages at death that has a lower average than the distribution of other UK regions.

It is not possible to describe, let alone predict, how factors combine at different points over a lifetime to affect an individual’s lifespan. We can only understand some of the factors based on probabilities. It would be a specious argument to factor one possible determinant of lifespan into the question of what age of eligibility should be.

The survival expectations between English women and Scottish men depend more on gender than region:

As there seems to be a consensus that gender should not be used as a factor for setting age of eligibility (and there is some known causation mechanism from gender to death rates), it seems unlikely a factor based on region could be justified.

Focus on those who die early and late

Even if varying age of eligibility by region, or any other factor, is rejected, inequality in lifespan can still be factored into policy. For example, resources can be spent on identifying and addressing the causes and consequences of inequality. Or, the age of eligibility could be set to target not only a percentage of life spent receiving the pension on average, but also a minimum percentage of a cohort likely to survive to receive the pension.

The inequality argument tends to focus on the numbers of people who “die too early”, but policy should also consider the other group missed by the life expectancy indicator: those who “die late”. There will still be sizeable numbers of Scottish men living to the oldest ages when they are likely to value the pension most.

A state pension therefore needs to be relied on to pay the oldest people decades into the future. A sustainable pension can fulfill its purpose of longevity insurance against “living too long”. This is becoming increasingly important as more people live to the oldest ages.

An appropriate eligibility age will be one which, along with other policy settings, ensures a good state pension can be sustained given the economic and demographic realities.

Please state your assumptions. What do you assume the state age pension is intended to achieve? Is it a safety net, to prevent poverty by paying a means-tested annuity? Or is it analogous to the repayment of unused income taxes paid through working life so that ‘equity of return on investment’ is your focus? Without that, how can anyone even begin to answer the question in your opening line?

Thanks for your comment. I agree that if designing a state pension then it’s best if there’s a clear understanding of what it should achieve. The points made in this post come to the same conclusion. How to allow for variation in life expectancy in state pension age shouldn’t be considered in isolation, as it’s one policy setting among many which together should ensure a good state pension can be sustained. Personally, I see the primary purpose of a state pension as longevity insurance against living too long – but exactly how that is delivered and how it works with private pensions or other aspects of the pension system will vary by country.

A focus on equity in coping with unequal lifespans is not necessary if the purpose of the pension is a safety net for those who live ‘too long’ or otherwise have no resources in feed, house and cloth themselves. All those factors that are interconnected and affect lifespans are interesting, but not relevant. They play a role in how mortality and morbidity patterns emerge, but a policy decision to treat all people equally, whether they are male, female, Scottish highlanders or Chelsea bankers means they will each get a means tested life annuity if their circumstances are equal.

On the other hand, if equity matters, and Government policy is that the manual labouring Glaswegian dockside workers (if they still exist) should get special treatment because of their mortality patterns, then it takes no time at all to figure out that fiddling with pension rules is not the way to achieve equity. Who is to judge equity? Instead, the tax system is the mechanism to use. It already has had to deal with the question of equity. I’d suggest it best not to introduce a new system that also needs political argument over the definition of equitable. This reasoning leads to the inevitable conclusion that the only viable course for state pensions is the means tested annuity approach – the safety net. The alternative approach, that we see in Australia for example, leads to distortions, complexities, wasted resources, rorting, manipulation and political churn.